Modernize and simplify analytics infrastructure

REAL-TIME RISK AND PORTFOLIO ANALYSIS

Converge streaming and historical data in our time series data warehouse with integrated pricing and risk models in a single platform to achieve real-time risk and portfolio analysis and keep pace with the market. Generate on-demand risk results for multiple models to meet both business and regulatory requirements. Perform ad hoc scenario analysis at scale to test portfolio risk exposure and make decisions based on financial data visualization for future trades.

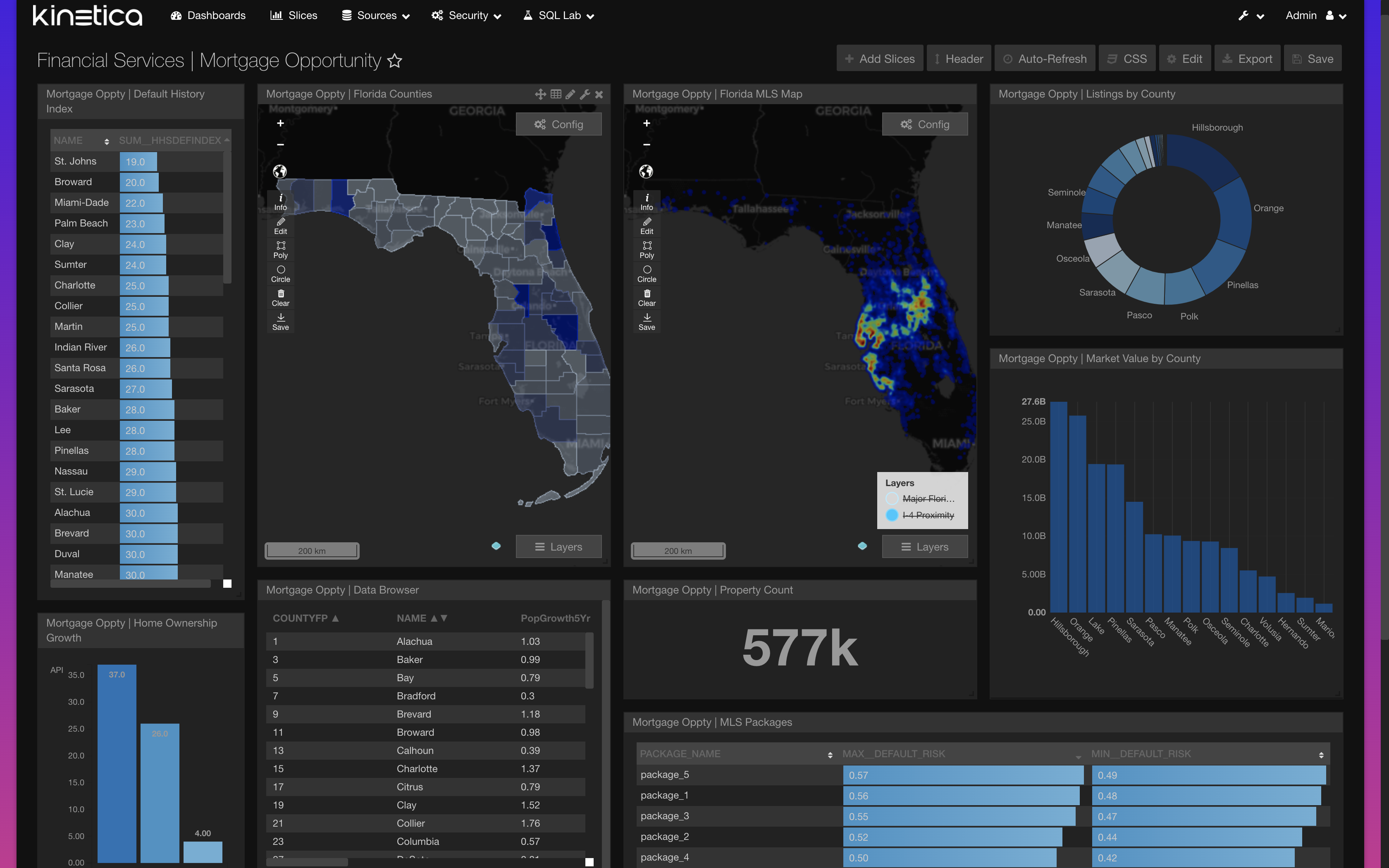

MORTGAGE RISK & OPPORTUNITY ANALYSIS

Beat the competition with faster, more accurate modeling and valuation of real estate assets for risk and portfolio analysis at scale. Enrich mortgage default risk analysis with diverse streaming, historical, and geospatial data sources to uncover interesting investment opportunities. Apply statistical models for additional insight into optimal assets to buy and sell. Analyze scenarios in detail to reduce risk and generate better returns.

ACCELERATED TRANSACTION COST ANALYSIS & TRADE OPTIMIZATION

Generate on-demand transaction cost analysis (TCA) reports to determine the effectiveness of complex transactions. Deliver fast analytics on streaming and historical trade data to understand trade execution, timing, and cost. Help traders to reduce slippage and maximize trade revenue while satisfying best execution regulations. Use the power of machine learning to run models on TCA data and deliver predictive insights that improve future trades. Enhance client-facing TCA applications to deliver a self-service experience that stands out.

SYSTEMIC RISK ANALYSIS

Accelerate complex systemic risk analysis across disparate data to meet critical regulations, like Fundamental Review of the Trading Book (FRTB) or BCBS 239. Leverage fast results to run more simulations and stress tests to assess exposure. Perform “what if” analysis at scale and adjust variables for market conditions, volatility, and other factors to more precisely model the impact of real-world events on systemic risk.

Book a Demo!

The best way to appreciate the possibilities that Kinetica brings to high-performance real-time analytics is to see it in action.

Contact us, and we'll give you a tour of Kinetica. We can also help you get started using it with your own data, your own schemas and your own queries.