Analyse Risk and Compliance across all your data in seconds-not hours

Calculating timely risk exposure and ensuring compliance relies on being able to quickly and easily analyze vast quantities of time-series data from multiple sources across the business.

Kinetica makes it quicker and easier to ingest these datasets in real time and perform all necessary data joins and complex risk analysis against all your data – at petabyte scale.

Real-time performance that fits your budget.

Fast ingest and query

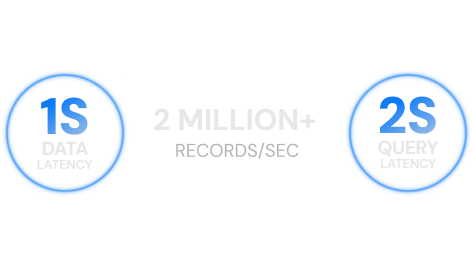

Financial institutions typically require a 1-second data latency SLA (loading 600K to 2 million records per minute) and a 2-second query latency SLA. Kinetica provides fast insights on the freshest data.

Eliminate the need for continuous monitoring and tuning with a database designed for real-time data.

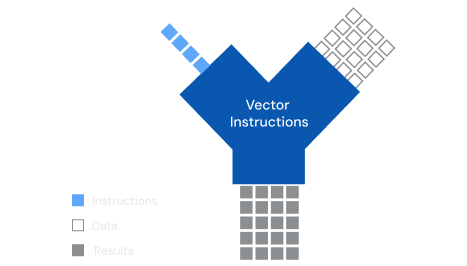

Complex Analytics using standard SQL

Use time bucketing, date-time functions, window functions, ASOF (fuzzy matching) joins, and materialized views to maintain continuously updated metrics at speed and scale—all with standard SQL.

With Kinetica, you can ingest, query, and maintain self-refreshing views simultaneously, delivering richer analytics while eliminating the need for constant monitoring and tuning to manage growing data volumes.

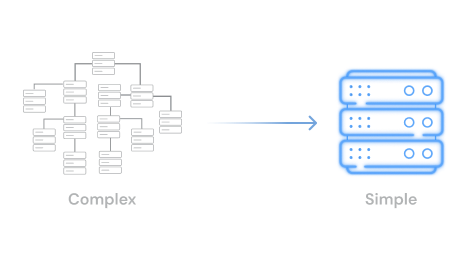

Lower Cost of Ownership

Kinetica offers rich OLAP, time series, streaming, graph, and vector search capabilities in a single database, reducing system compute, storage, and operational costs.

Additionally, Kinetica can replace hundreds of thousands of lines of microservice code with in-database SQL queries, creating a simpler, more agile platform with lower total cost of ownership.

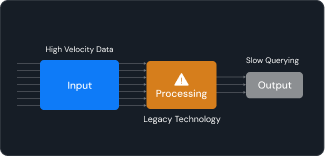

Legacy Technologies are not delivering

Slow

Legacy technologies constantly struggle to keep up with high volume ingestion (600K to 2 million records per minute) and querying (100+ QPS).

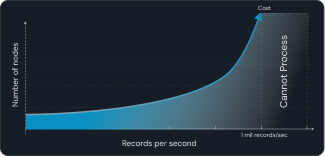

Hard to scale

Requires heavy tuning and monitoring to handle surges in data volume. Huge infrastructure spend on heavy weight nodes to host analytic microservices. Massive legacy technology clusters to meet SLAs.

Maintenance Nightmare

Death by a thousand microservices. Each analytic function requires custom developed as a microservice. Constant development required of microservices for new metrics.

Kinetica: Powering Speed, Scale & Simplicity

Kinetica - complex analytics on real-time and petabyte scale data sets at the lowest TCO.

| Scalable real time ingest | Scalable Key Lookup | OLAP | Time Series | Graph | Vector Similaritry Search | GPU Acceleration | Low CapEx & OpEx Costs | |||

|---|---|---|---|---|---|---|---|---|---|---|

Analytic DBs

(SAP Sybase IQ,

Timescale, ClickHouse...)

| ||||||||||

NoSQL DBs

(Cassandra, DataStax...)

| ||||||||||

Talk to Us!

The best way to appreciate the possibilities that Kinetica brings to high-performance real-time analytics is to see it in action.

Contact us, and we’ll give you a tour of Kinetica. We can also help you get started using it with your own data, your own schemas and your own queries.