Ask your friends why they go to Vegas, and I’m sure you won’t get the same answer twice. Casually surveying a few colleagues and friends yielded “the food and nightlife,” “bachelor party weekend,” “catching the Jerry Seinfeld show,” “Calvin Harris is DJing,” “CES conference,” and…“rock climbing.” (It’s actually an easy day trip to Red Rock Canyon, Valley of Fire, Zion–but I digress.) What could these wide-ranging answers possibly have in common?

Answer: they’re not gambling.

Since the Great Recession, Las Vegas has come to Jesus. Not literally. But they’ve come to accept the truth in numbers: in the ’90s and ’00s, over half of Las Vegas Strip revenues came from gambling. But in recent years, gaming revenue mix has steadily declined. In 2017, only 33% of Las Vegas Strip revenue came from gaming, while the other 67% came from growth in food and beverage, hotel, entertainment, and nightlife.

Entertainment, celebrity restaurants, nightclubs, luxury accommodations, and other experiences are shifting the revenue mix away from gambling, and it is affecting everyone in the industry.

At core, this is a data challenge. Gene Lee, the chief analytics officer at Caesars Entertainment, divides it into two categories: customer and product. On the one hand, casino properties must continually reinvent the product to appeal to a shifting demographic. On the customer side, they need to capitalize on intelligent marketing. This means offering the right incentives to the right customer at the right time via the right channel.

Product development requires mid-term to long-term planning. It takes a long time to change a casino, experiment, and get a read on reception to those changes. Profitability instead relies on successful customer marketing.

“We have to make bets on whether the customer gets a free hotel room, slot credit, golf, food, transportation, sold out tickets, or a room upgrade,” Lee says. “We need the marketing offers to be profitable and get the right margin for us.”

To do this successfully demands high-speed data analytics. The casino wants to deliver offers that have low variable cost, and high perceived value. “The secret is out,” says Lee. “We give people free upgrades.” But a great deal of calculation goes into those tailored giveaways. Caesars uses their analytics to develop better predictive modeling techniques to understand different customer scenarios, to see how much marketing encourages a trip versus cannibalizes from a trip someone would have taken anyways.

In fact, what marks Caesars success in a crowded field is their analytics capabilities. The industry at large is still going through consolidation—and the slow process of integrating all their technology and data. Smaller competitors don’t have the scale, and newer ones don’t have the data history. Caesars has both, along with centralized, integrated data–and the latest NVIDIA (NVDA) GPU Tesla cards to play with.

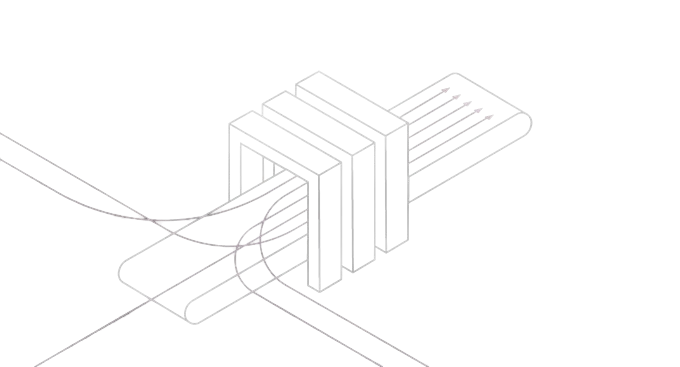

“GPU technology means faster chips, and that enables faster analytics that would normally take exponentially longer to process,” Lee says. “For real-time analysis, Kinetica is our Manhattan real estate.”

An accelerated GPU database like Kinetica can deliver not only real-time analysis, but also automated, AI-driven analysis on the entire corpus of historical and live, streaming data in milliseconds, using the brute-force computational power of GPUs that Caesars needs to compete in a data-saturated, hyper-competitive, and crowded marketplace.

Caesars then converges GPU-accelerated machine learning with business intelligence to uncover interesting insights that are too complex, too time-consuming, or too inaccessible for an individual to explore on their own. From there, they can use the GPU database for micro-segmentation. “Kinetica is the best tool for analytics to slice and dice data,” says Lee. It will deliver advanced analytics going forward.

“Our business is detecting needles in a haystack. Most people ignore outliers, but to us, that’s a million-dollar customer,” says Lee. “A fast database can help with discovery analytics and fly through large amounts of data really quickly, to find the outliers that translate into big opportunities for us.”

They’re willing to bet the house on it.

“It’s the way to compete,” says Lee. “What makes Caesars special is our analytics capability.”

This article was originally published on Forbes on 5/31.

Amit Vij is co-founder at Kinetica.